Step 1

Donate to St. Vincent de Paul to support needy families in Arizona.

Step 2

File your taxes and claim the credit by using AZDOR Form 321

Step 3

Receive your tax credit! (up to $987)

How is a credit different from a deduction?

A deduction reduces the amount of your income upon which the tax is determined. A credit reduces your tax liability as if you had already paid the tax.

Below are simplified examples that demonstrate the difference.

TAX DEDUCTION EXAMPLE

Mary and John earned $50,000 this year. They made an $987 gift to ABC Charity. Although ABC Charity is a nonprofit 501(c)3, it is not a Qualifying Charitable Organization for the tax credit. Mary and John can take a deduction for their gift which, after itemizing deductions, reduces their taxable income by $987. Their tax liability is now based on $49,013.

TAX CREDIT EXAMPLE 1

Betty and Ralph earned $50,000 this year. They made an $987 gift to SVdP which is a Qualifying Charitable Organization for the tax credit. Their Arizona tax liability based on $50,000 in earnings is $1,680. They can take an $987 credit against their tax liability reducing it to $742.

$1680 Betty and Ralph's original AZ tax liability

− $987 AZ Charitable Tax Credit

$693 Betty and Ralph's final AZ tax liability

TAX CREDIT EXAMPLE 2

Sam and Linda earned $50,000 this year. They made an $987 gift to SVdP which is a Qualifying Charitable Organization for the tax credit. Their Arizona tax liability based on $50,000 in earnings is $1,680. Their payroll withholding for state taxes was $1,500. After applying their tax credit for their gift to SVdP, they received a refund of $807.

$1680 Sam and Linda's original AZ tax liability

− $987 AZ Charitable Tax Credit

$693 Sam and Linda's final AZ tax liability

− $1500 Payroll Withholding

$807 Refund due Sam and Linda

FREQUENTLY ASKED QUESTIONS

Yes. The maximum amount that can be claimed on the 2025 Arizona Income Tax Return is $987 for joint filers and $495 for single filers. Donations made for the 2026 Arizona Income Tax Returns can be up to $1,009 for joint filers and $506 for single filers. Learn more about this change: https://azdor.gov/tax-credits/contributions-qcos-and-qfcos

Credit for Contributions to Qualifying Charitable Organizations was formerly known as the Working Poor Tax Credit. Donors may now take up to $495 in tax credit and couples filing jointly may take up to $987 in tax credit for gifts made to St. Vincent de Paul.

Yes. Each tax credit is separate, so you can take the Charitable Tax Credit in addition to tax credits for schools and foster care agencies. See Form 301 on the Arizona Department of Revenue’s website for other credits you may be able to take.

You do not have to donate the whole amount at once. Donations given throughout the year that add up to the $495 and $987 limits qualify for the tax credit. We can even set up a monthly gift option for you to spread the gifts out over the year. For more information, please call us at 602.261.6884.

You simply need a receipt from St. Vincent de Paul, which every donor receives in the mail after making a monetary gift. The form you need to take the tax credit is Arizona Form 321, which is available on the Arizona Department of Revenue’s website and is included with many of the available self-filing tax programs like Turbo Tax.

No. The Tax Credit only applies to voluntary cash donations.

St. Vincent de Paul’s tax ID is 86-0096789. Our Arizona QCO code is 20540.

Carla Stafford, a dedicated flight attendant for 22 years, found joy in sharing her warm smile with every passenger she served. However, after facing numerous health challenges including PTSD, major depressive disorder, and anxiety rooted in an abusive relationship, Carla had to rely on medications that took a painful toll on her dental health, ultimately leading to the loss of her teeth. Despite these hardships, Carla is determined to reclaim her smile, which she views as a meaningful gift to share with others. With the compassionate support of ongoing dental care at St. Vincent de Paul's Delta Dental of Arizona Oral Health Center, Carla now feels hopeful for a brighter future and the chance to smile again.

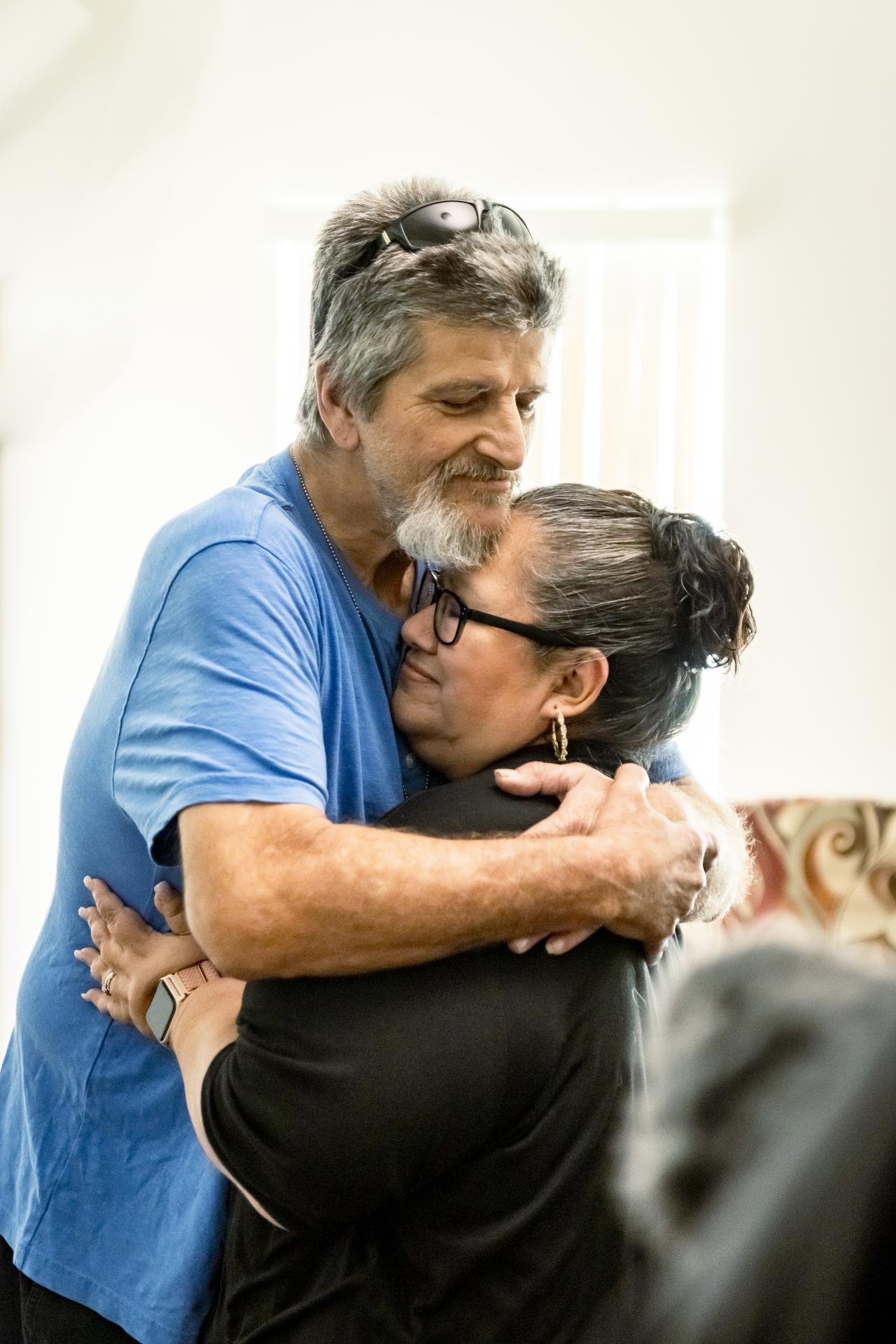

At a time when Guillermina was expecting her third child and facing financial challenges, she sought support at St. Vincent de Paul’s NextPhase Family Dining Room, where she found crucial help with meals and essentials like diapers for her children. Over the years, the dining room became more than just a place to get a hot meal and turned into a second home where her children grew up. Today, as her circumstances have improved, Guillermina gives back as a volunteer, helping to prepare and serve meals each night as a way of expressing her gratitude.

Kenneth Gutierrez found a fresh start at Ozanam Manor, St. Vincent de Paul’s transitional housing program for seniors, veterans, and adults living with disabilities experiencing homelessness. After his wife's death, Kenneth struggled to cope with his loss, which led to incarceration and challenges in finding a place to live without any support systems. Ozanam Manor offered him a second chance and a place to find stability and hope through a warm bed, meals, a dedicated social worker, and a Workforce Training Program. With the wraparound services, Kenneth graduated from the program and transitioned into his own apartment. Today, he works as a service coordinator at De Paul Manor, SVdP’s new 100-bed transitional housing facility, helping others find their path forward.